Payroll calculator for hourly employees

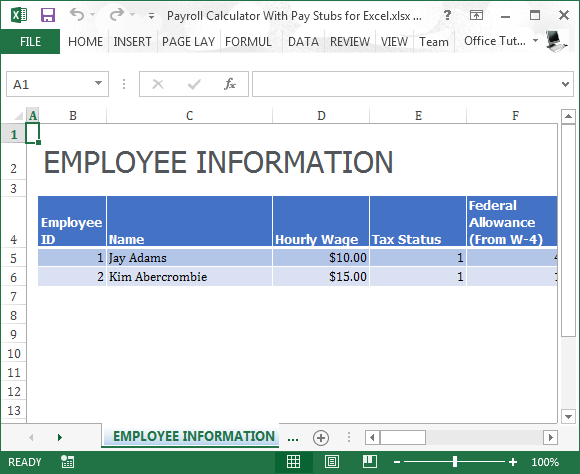

Dont forget to increase. The first worksheet is the employee register intended for storing detailed information about each of your employees.

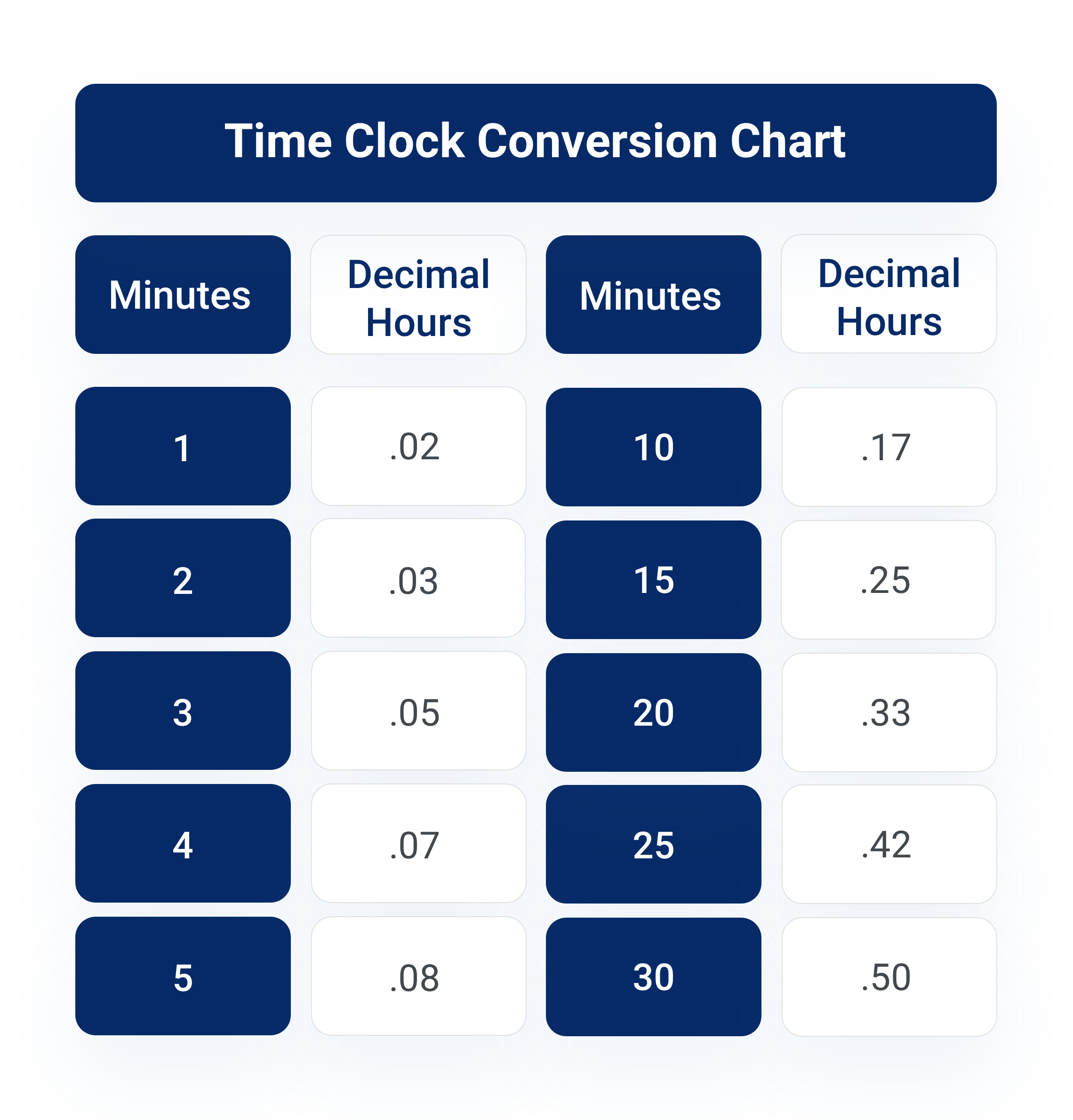

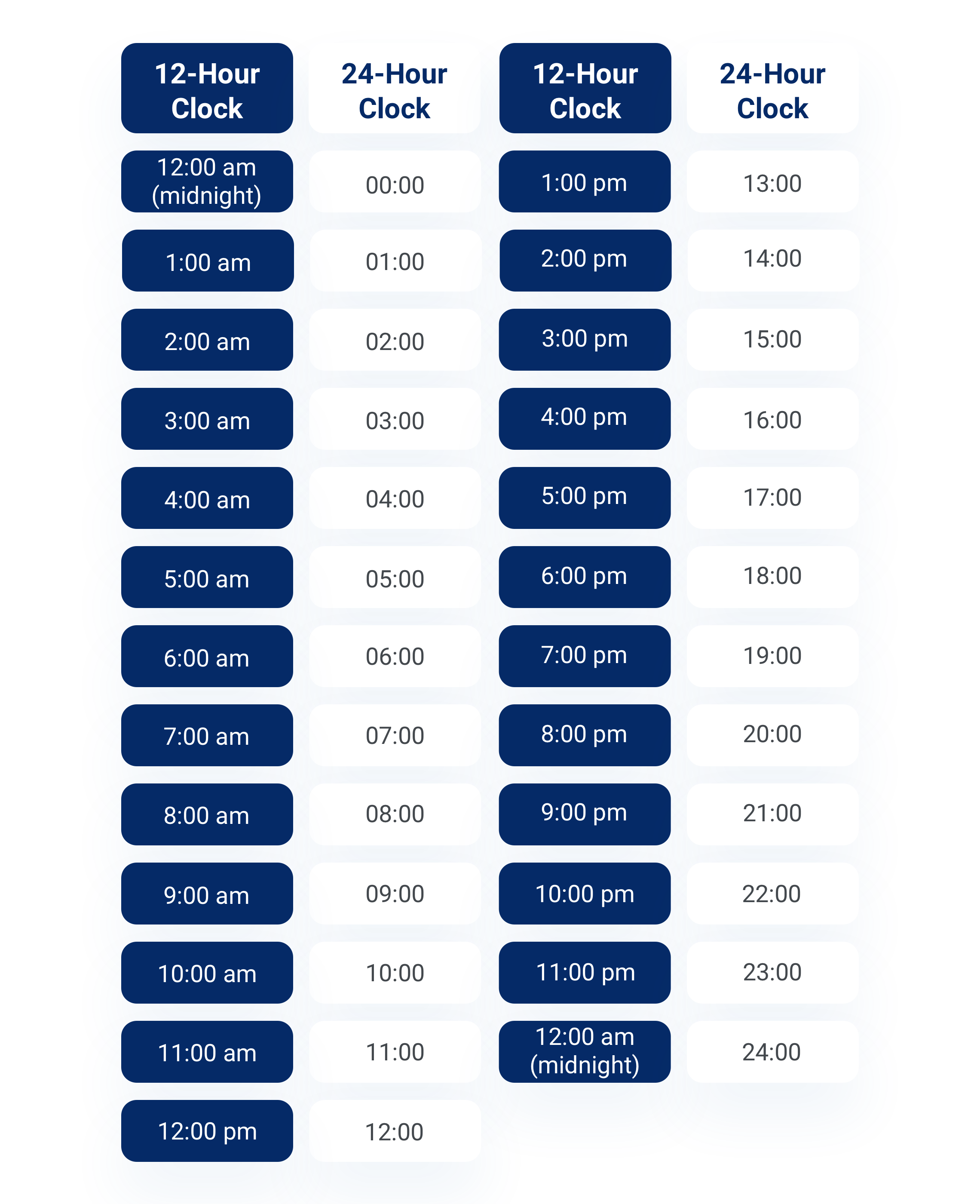

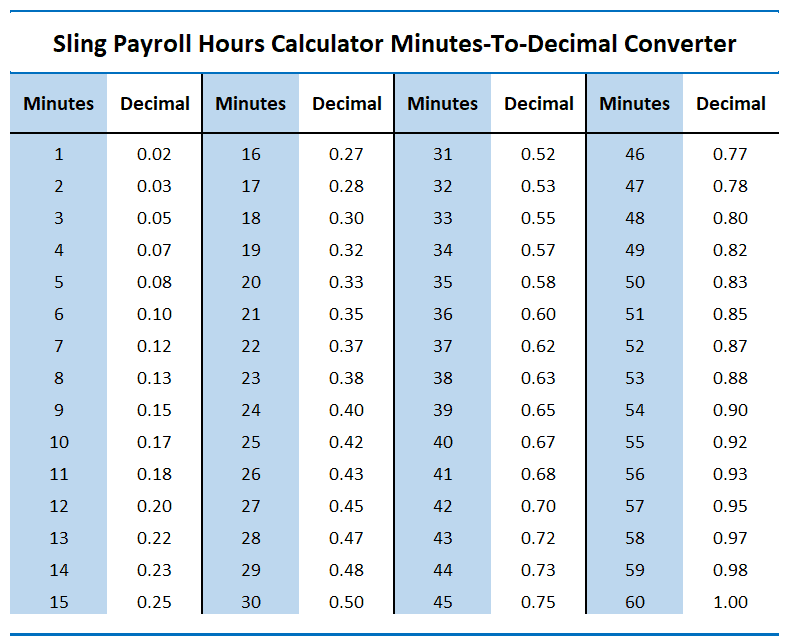

Time Clock Conversion Calculator For Payroll Hourly Inc

If you have hourly employees you know just how difficult it can be to manage their hours and run payroll.

. Determine the right amount to deduct from each employees. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The payroll calculator worksheet helps you with calculating the employee payroll based upon regular hours sick leave hours and vacation.

2021 June 2022 July 2022 Aug. Bonuses commissions and tips are all part of gross wages as well. This Idaho hourly paycheck calculator is perfect for those who are paid on an hourly basis.

California Hourly Paycheck and Payroll Calculator. Luckily our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for. Switch to Minnesota salary calculator.

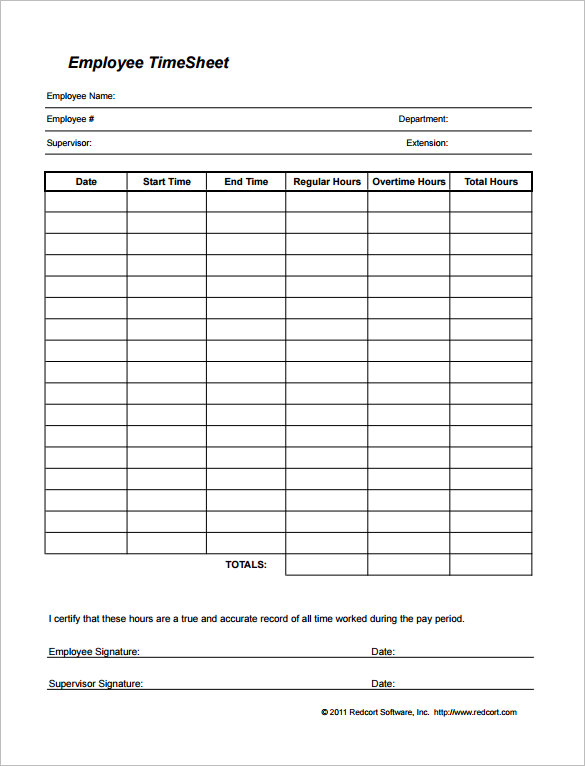

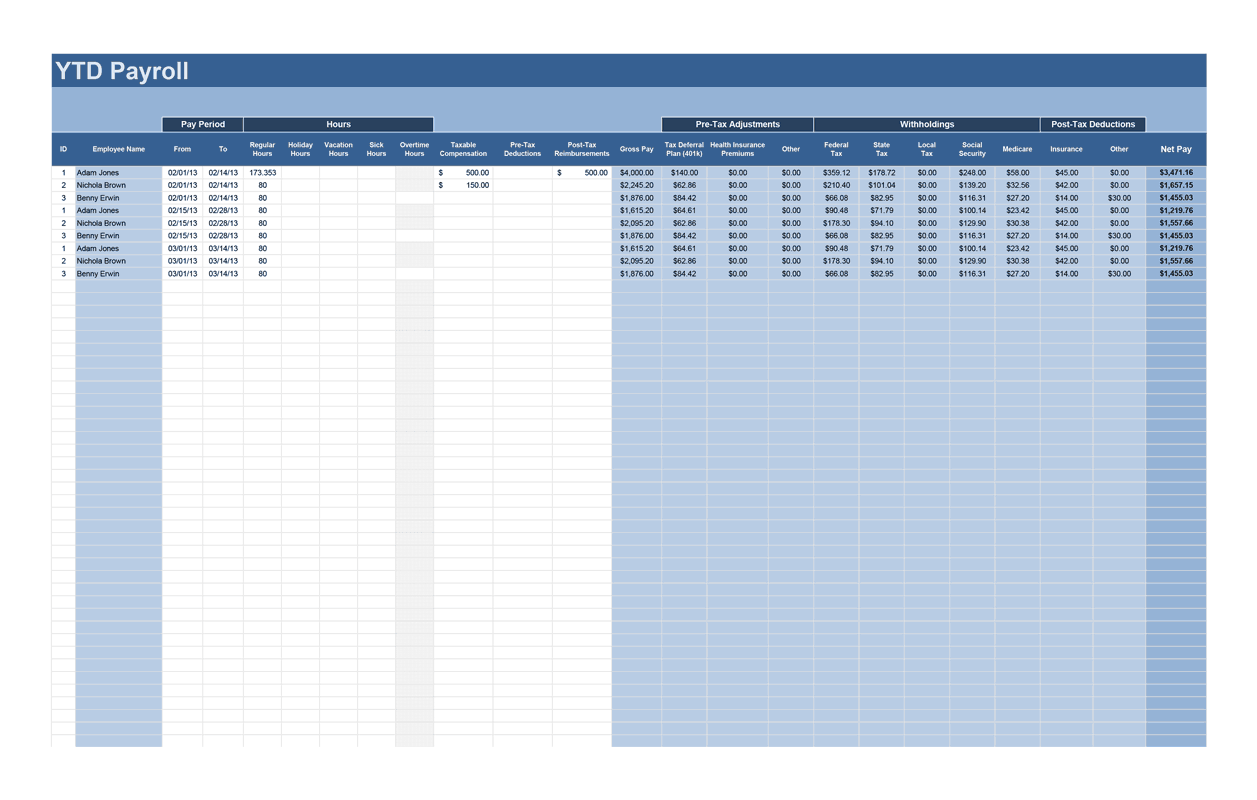

This payroll template contains several worksheets each of which are intended for performing the specific function. This Nebraska hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees.

2021 June 2022 July 2022 Aug. Multiply the number of hours worked by the employees hourly pay rate. Our payroll calculator will figure out both federal and Kansas state payroll taxes for you.

Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. For salaried employees divide each employees annual salary by the number of pay periods you have over the course of a year. Heres a summary of what you need to know when youre calculating federal payroll taxes.

Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program. Use Our Free Hourly Paycheck Calculator. Make sure to calculate any overtime hours worked at a higher rate.

See Minnesota tax rates. The tax rate can range from 0 all the way up to 37. Dont forget to.

To keep things simple for you as the business owner we recommend using a tax tip calculator like this one to make sure youve got your withholdings. If you would like to see a detailed rundown head on over to our step-by-step guide for more information. If your employees have 401k accounts flexible spending accounts FSA health savings accounts HSA or any other pre-tax withholdings subtract them from gross wages prior to applying payroll taxes.

All you have to do. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Exempt means the employee does not receive overtime pay.

Time. Need help calculating paychecks. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. Texas Hourly Paycheck and Payroll Calculator. Well do the math so you can write paychecks and take care of taxes.

Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance. For all your hourly employees multiply their hours worked by the pay rate. If you terminate or lay off an employee you must pay the employee their final paycheck within six calendar days or the next workday if the sixth day is on a day when the business is.

Simply grab each employees W-4 and wage information and enter them into our handy payroll withholding calculator. SurePayroll does all the calculations for you allowing you to focus on more important areas of your small business. Switch to Alabama salary calculator.

This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Hourly Paycheck and Payroll Calculator. Were making it easier for you to process your payroll and give your employees a great experience with their payslips.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. How to calculate payroll for tipped employees. Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector seasonally adjusted.

Understand your nanny tax and payroll obligations with our nanny tax calculator. Fortunately you dont have to tackle this task on your own. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch. Need help calculating paychecks. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior.

For hourly employees multiply the number of hours worked by their pay rate and make sure you dont forget to take overtime into consideration. Industry Average hourly earnings Average weekly earnings. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Hourly employees must be paid 15 times their regular hourly rate for any time worked beyond 40 hours in a week.

Switch to Nebraska salary calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. See Kansas tax rates.

Then enter the employees gross salary amount. For all your hourly employees multiply their hours worked by the pay rate. Federal Payroll Taxes.

Switch to Louisiana salary calculator. Heres a quick overview of what you need to know when youre calculating federal payroll taxes. For all your hourly employees multiply their hours worked by the pay rate.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Deduct federal income taxes which is the biggest tax that your employees will pay. This Alabama hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. On tips as easy as possible is a win-win for everyone so you can withhold the right amount of taxes from their hourly or salaried base wages. This Minnesota hourly paycheck calculator is perfect for those who are paid on an hourly basis.

For employees who are not covered by the plan report their income and deductions using your payroll program account at the standard rate of 14 times the employees premiums for example RP0002 Where an employee was transferred between both accounts in the same calendar year file a separate T4 slip for each account.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

3 Ways To Calculate Your Hourly Rate Wikihow

Time Clock Conversion Calculator For Payroll Hourly Inc

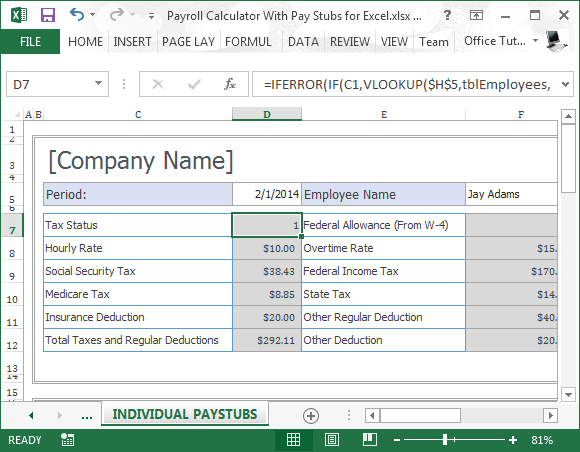

Payroll Calculator With Pay Stubs For Excel

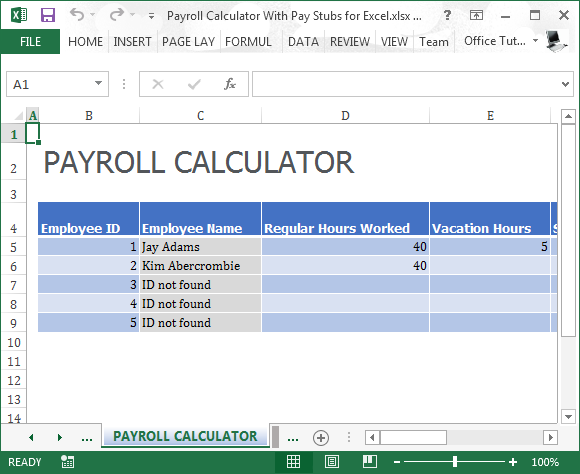

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Payroll Calculator With Pay Stubs For Excel

How To Calculate Payroll For Hourly Employees Sling

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Calculator Application Devpost

Payroll Calculator Free Employee Payroll Template For Excel

Hourly To Salary What Is My Annual Income

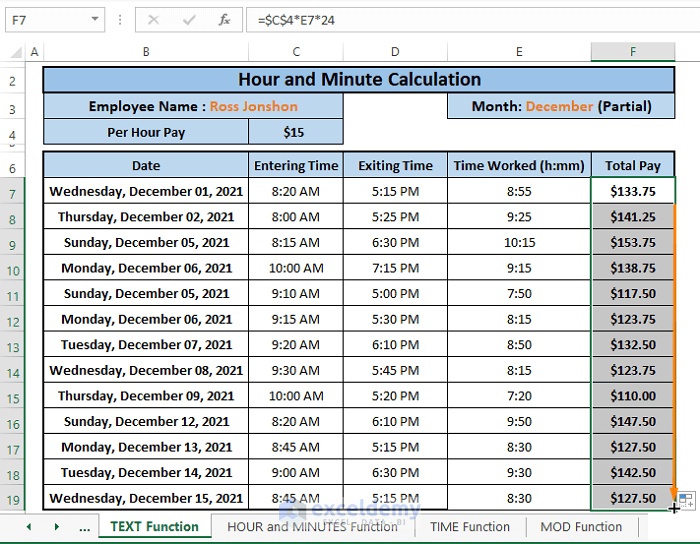

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways